Santander and TSB said they might allow it, depending on your situation, although Santander would charge a £295 fee for each consent period.

Neither would Nationwide on a primary residence. If you do seek permission for a short-term rental of your entire home – for example, when you are going on holiday for a week – the Co-op, Clydesdale bank, Yorkshire bank, the Bank of Ireland, the Post Office, RBS and Virgin Money would not allow it. The Council of Mortgage Lenders (CML) says it is likely that all owner-occupiers will find a clause in their paperwork preventing the letting of the property on any basis without prior consent. Without consent, any Airbnb host with a mortgage is likely to find themselves in breach of their home loan contract.Ĭustomers with Bank of Ireland, Barclays, the Co-op, Clydesdale bank, Coventry building society, Halifax, HSBC, Lloyds bank, Leeds building society, Metro bank, Nationwide, the Post Office, Royal Bank of Scotland/NatWest, Santander, Skipton building society, Virgin Money, Yorkshire building society and Yorkshire bank who let out their property on Airbnb (or a similar site) without consent are breaching the terms of their contract.

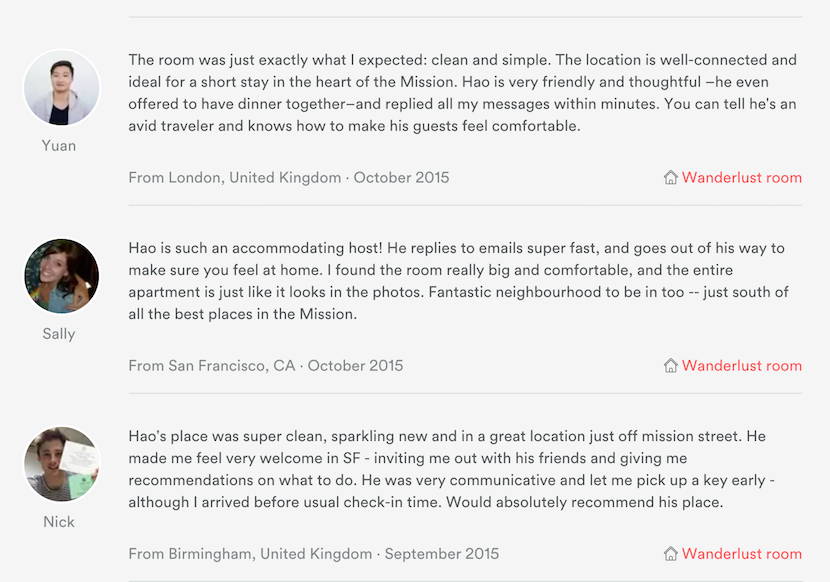

But some might wonder whether a lender would really find out if a mortgage holder had paying guests staying every now and again? Should you just do it anyway and hope for the best? And what if you only want to rent out a room? What the lenders told us Our findings suggest the big winners are likely to be the “property elite”: older homeowners, many well-off, who own their homes outright. It’s the second tax break which will benefit such “landlords”, following on from the increase in the “ rent-a-room” allowance (which allows you to rent a room in your home to a lodger) from £4,250 to £7,500 a year that takes effect from next week. The popularity of sites such as Airbnb, which enables you to offer paying guests temporary accommodation in your home for short periods, has risen sharply in recent years, and in his March budget the chancellor announced that the first £1,000 of income earned in this way will be tax free from April 2017.

0 kommentar(er)

0 kommentar(er)